Covid-19 Business Support

This lockdown was announced at 17 August 2021 and has triggered three of the government's existing policies - Resurgence Support...

Your step-by-step guide to meaningful customer feedback

Make a list of seven key clients or customers to call for feedback. Decide who is going to make the...

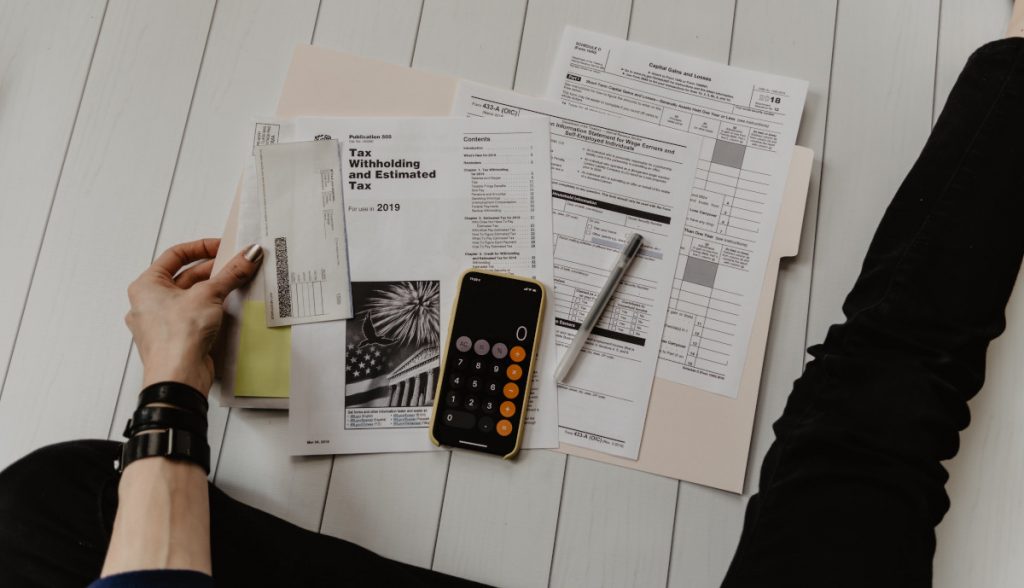

Does the new 39% tax rate affect you?

The new 39% marginal rate that applies to all employment income over $180,000 is now in force. Consider how the...

Good communication = repeat customers = more profit

Did you know customer retention is faster and, on average, costs up to seven times less than customer acquisition? If you’re...

Paid parental leave applications online

Now’s the time to let staff know applying for paid parental leave just got easier. As of March 2021, your staff...

Trusts Act 2019, What you need to know

Trusts Act 2019 As of 30 January 2021, there will be significant changes to New Zealand trust law. Therefore, 2020...

Keeping you and your staff pain free in 2021

Whether you and your staff are sitting or standing at work, there are risks to physical and mental wellbeing that can...

Lead by example: be a mental health champion

Did you know the main reason people take time off work is due to poor mental health? So, it’s in your...

Implementing health and safety so it sticks

Have a health and safety policy and plan in place? Great! But how can you ensure everyone’s 100% on board? Here...

Health and Safety: Do I need help getting it right?

Since the Health and Safety at Work Act 2015 came into place, specialised advisors and consultants have been popping up all...

From Airbnb to boarders: What’s new for property owners?

Renting your home or bach online? If you rent a property for short periods, you need to know your tax...

What’s new in 2020?

Partnership Law gets a makeover: The Partnership Law Act 2019, which governs business partnerships ...

Are you a landlord? Keep up with the changes

With a third of New Zealanders renting homes, and some for a lifetime, it’s key to have clear, fair rules...

Five steps to a healthy rental property

To boost the quality of rental properties in New Zealand, the Healthy Homes Guarantee Act was passed in 2017. If...

New kilometre rate for claiming motor vehicle expenses

Are you using your car for business purposes? It’s timely to outline the process for claiming tax on your work...

Four-week checklist to keep tax time low-stress

Week 1: First things first Talk to your accountant or bookkeeper. They’ll tell you what you need to do before...

Four top time-saving tips

Not enough time in the day to get everything done? Try these tips to keep calm and increase productivity. Having...

Rental losses ring-fenced from 1 April 2019

The new law on ring-fencing rental losses is now in force, which means: In most cases ring-fenced deductions will be carried...

10 inspirational podcasts for business owners

Spend a bit of time commuting or travelling for work? Podcasts are the new radio. Here are 10 free series...

Protection with patents and trade marks

If you’ve got a new invention, are launching a brand or marketing a new stream of business, it’s important to...

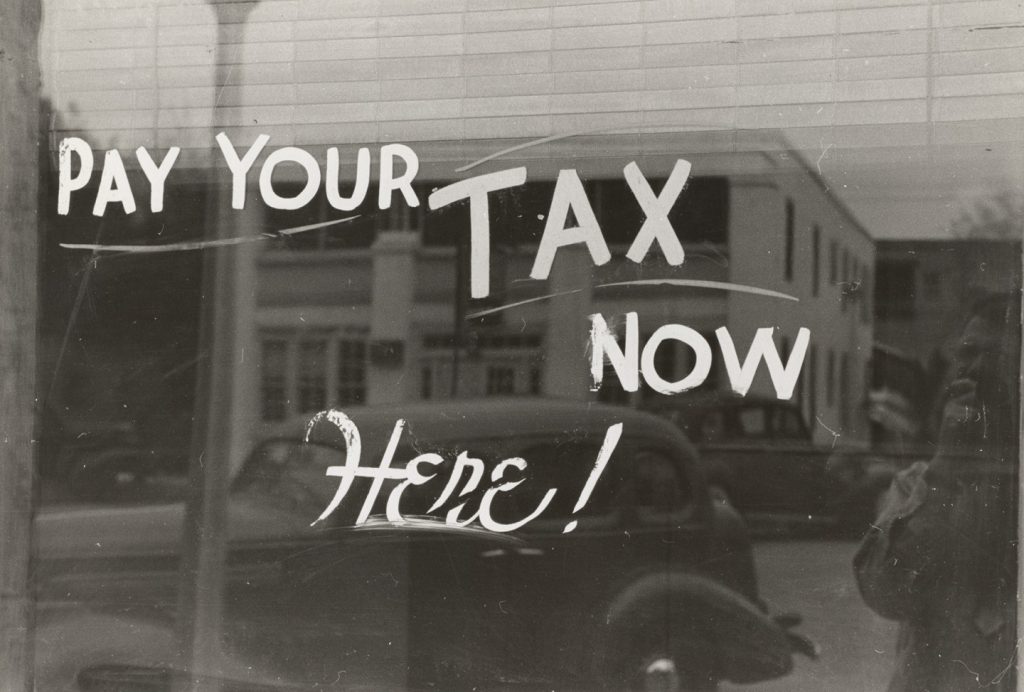

Pay your taxes by cheque?

Five new ways to do it. If you normally write a cheque to pay for your taxes, it’s time to decide...