Before you start

Structures

There are four options.

- Sole ownership

- Partnership

- Company

- Trust

The following options apply to married or de facto couples:

Sole Ownership

It could be desirable for the partner who has the higher income to own the property if the project is expected to make losses. In this way, the advantage to be gained from tax losses will be maximized. Similarly, if it is expected to generate profits, it might be better for the partner with the smaller income to own the property.

Please read the section on tax warnings following.

Partnership

It is usually assumed the partners will be equal, particularly if the funding has come from a joint bank account. However, this does not have to be the case. The partnership can be unequal if you prefer it that way. However, if you want an unequal partnership, you will need to be careful with your paper work. See notes following.

Company

There are certain advantages of having a company.

- It is easy to rearrange ownership. You only have to change the shareholding. You might want company ownership while there are losses but trust ownership when there are profits. You may also wish to rearrange the proportion of ownership. All you have to do is sell some shares instead of going through the more expensive process of conveyancing.

- There are some tax advantages. You will find a discussion of these following.

- A limited liability company can reduce your personal exposure to risk. Apart from a personal guarantee you may have had to give for a mortgage, you would not be personally responsible for any other company debts unless you contributed to the claim. The claimant would have to sue your company not you.

Trust

A trust, in some respects, is like a company. Assets owned by a trust are separate from yourselves, and though you may be the trustees, you do not own them.

If you require long term care when you are old, your assets have to be sold to pay for this. A family trust helps to protect those assets. Since you do not own the assets in the trust, they cannot be sold to pay for your maintenance. However, any money owing to you can be claimed from the trust.

If you are in business your personal assets are constantly at risk. A limited liability company is not fool proof protection. For this reason people like to use a family trust to protect their assets. Most start by putting their home in the trust or trusts.

There is a major tax disadvantage of having a rental property in a trust. If it makes losses you are unable to use them to reduce your personal income tax. There has to be sufficient other income in the trust, apart from dividends from New Zealand companies, to set off against those losses. If not, the losses can be carried forward until there is taxable income to set off against them.

Taxation – Company structure

Companies can pay directors’ fees to directors and other remuneration to shareholders. This can be a handy way of diverting some income to the lower income earner. There are limits. You have to be able to justify the amount of income distributed in this way. You may be taxed twice if your claims are found to be excessive. The excess will be considered company income to be taxed at 28 percent and then a dividend to the person receiving it, to be taxed again.

Tax Warnings

You are entitled to arrange your affairs to minimize the effect of tax. However, you are not entitled to enter into arrangements which have the effect of changing the incidence of tax, unless there is a perfectly good commercial reason and the tax effect is relatively immaterial. Some years ago, three accountants decided to transfer the practice equipment to their wives. They wanted their wives to make a profit by leasing the equipment back to them. The Inland Revenue Department was not happy and challenged the accountants in court. The accountants lost because the principal reason for rearranging their practice was to reduce taxation. There would not have been a rearrangement if the leasing had been set up at the start. In another case an accountant sold his car and then got his family trust to buy one and lease it to him. That was not tax avoidance

Therefore, remember to be careful if you are contemplating rearranging your financial structure with only tax in mind. If you were to sell your rental property to your family trust, you could reasonably argue there is a good non tax justification and the tax effect is reasonably minimal. If, on the other hand, you rearrange the proportion of ownership in a partnership structure, when the rental property starts to make profits, there could be an argument from Inland Revenue Department this was done for tax reasons

You should also realize tax law is constantly changing. Something which might be good advice today could not be so good at some later date.

Documentation

Tax law works more on form than substance. Be very careful with your documentation. If you want to have an unequal partnership but are drawing the funds from a joint bank account, make sure there is documentation, confirming the person having the bigger share has borrowed half the difference from the one having the smaller share. If it is intended one of the partners is to receive a salary, be sure to record this in a written agreement valid for at least three years.

Borrowing Money

The law looks at the use for which the money was applied. If you want to move house and need a mortgage to buy the new place, the money borrowed is to buy the new house, even though you may retain the old one for rental purposes. The interest on the loan is not tax deductible.

Be careful with all documentation. Money borrowed for a company or trust should be paid straight into its bank account.

The mortgage documents must also be drawn up in the name of the entity borrowing the money and not in your name but you can still provide a security or guarantee.

Revolving Credit

Revolving Credit is a mortgage which fluctuates according to your deposits and withdrawals. Interest is charged on the balance each day. It therefore pays to put salaries and any other sources of income into the bank account and to withdraw money from it as late as possible. The Inland Revenue Department says each time you take money out you reduce the original debt. In this way, the original debt reduces very fast and within a short time all the borrowed money has become a personal debt and no interest is tax deductible. It is therefore unsuitable funding for rental property owned in your own name or in partnership.

Companies are separate entities for tax purposes. Money moving in and out of the bank account is not seen as repayment of a personal debt. Revolving credit can usually work nicely for a company.

Property Overseas

You will need to comply with the tax laws of that country as well as those of New Zealand. In the case of Australia, the tax laws are quite different from ours. Depreciation rates are different and you have to obtain the services of a quantity surveyor for valuing chattels. Don’t forget capital gains tax.

If you borrow money overseas, you may have to either pay nonresident withholding tax as a deduction from interest payments or pay Approved Issuer Levy. Sometimes these can be avoided by picking the right bank. See us and we will explain.

Negative Gearing

Gearing is the proportion of your own money compared with borrowed money used to buy the property. High gearing means more borrowed money than your own. Some properties are very highly geared. The owners sometimes borrow 100 percent of the purchase price to maximize losses and get tax refunds. In times of high inflation high gearing is most desirable, because your equity keeps increasing as the value of the property goes up. The government is subsidizing your investment through the tax refunds. However, if your property is not gaining in value, high gearing may not be such a good thing.

We do not recommend long term interest only loans. They indicate a property was bought with primarily a capital gain in mind. IRD could therefore argue the gain on sale is taxable.

At the time of writing (November 2009), we also need to warn you the Government may be looking at this area and be contemplating a change to the rules.

Robert Kiyosaki, a modern investment guru, says he always wants to see a positive cash flow from every investment. So long as he expects more money to be coming in than going out, including principle repayments of the mortgage, he is happy.

When you are up and running

Depreciation

Depreciation is a measure of the reduction in value of the asset each year. Depreciation rates vary according to the life of each asset involved. Carpets wear out more quickly than the walls of the house. The Inland Revenue Department recognizes a classification of about 24 different asset types each having its own depreciation rate. Obtain a value of all the chattels in the house. These diminish in value over time. The house, however, will probably rise in value.

You may choose whether or not you wish to claim depreciation. Having made the choice you may not change your mind. They would usually depreciate the chattels because these fall in value.

Legal Expenses

The costs of acquiring a property are not tax deductible. Therefore the legal costs involved in transferring it to you are added to the price you pay, for tax purposes.

Costs relating to finance are tax deductible. Be sure to ask your lawyer to distinguish between these two types of expenditure when rendering an account to you. Most lawyers fail to do this.

Real Estate Agent’s Fees

These are part of the cost of acquiring the property and are treated the same way as the conveyancing costs. Letting fees would be tax deductible but usually the tenant pays. Rent collection fees are tax deductible.

Valuation Cost

The cost of a valuation for buying a property is not a tax deductible cost. The cost of a valuation for obtaining finance, or determining chattels’ value for depreciation, is a tax deductible cost. Be sure to distinguish between these two types of expenditure when getting your bill from the valuer.

Repairs

Repairs are a cost involved in maintaining a property. If you buy a house in a rundown condition, the costs of doing it up are not tax deductible. They are part of the cost of acquiring the property and must be capitalized. This also includes any repairs of any kind that you do before your first tenant moves in.

Sometimes expenditure is a mixture of repairs and improvements. For example, you may decide you want to make the living room bigger. Part of the costs could relate to redecorating the living room but another part would be for the additional floor area. You would need to have these costs split for tax purposes.

Expenses you can claim

Here is a list of expenses you should consider claiming

- Accountancy

- Advertising for tenants

- Agent’s letting fees

- Bank charges including finance application fee

- Commercial cleaners

- Gardening

- Insurance

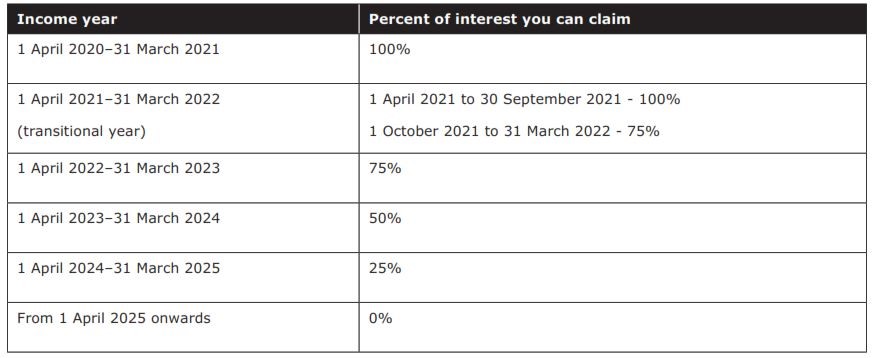

- Interest

- Light and power

- Costs of running your vehicle. A mileage basis is probably the most satisfactory. Consult us for details.

- Printing stationery and postage

- Rates

- Repairs and maintenance

- Telephone

- Valuation for finance or depreciation.

You could also claim for the use of your home for administration. However, make sure the cost of calculating the claim, including the accounting work, does not exceed the tax saving. Another marginal claim is for the use of your computer.

If your property is owned by a company, you should produce a proper set of accounts.

In the case of trust ownership, the important thing to remember is keeping an account of its indebtedness to yourselves and a record of the capital of the trust. You should prepare proper accounts for a trust, otherwise you risk overlooking transactions and being sued by discretionary beneficiaries. For example, profit is often attributed to beneficiaries together with related tax credits, if any.

Accounting

Accounting for sole ownership or partnership is much easier than for a company or a trust. The accounting can be done as part of the process of preparing your tax return.

Companies need to prepare a balance sheet. There should be a separate bank account for the company and transactions contained in it should be processed into their various income and expense classifications.

Accounting for trusts needs care. Decisions involving the trustees or beneficiaries need to be documented in the form of minutes. Decisions which might or could affect these two should also be documented. For example, if you wish to take money out of the family trust you will need to decide whether this is a reduction of its debt to you or a distribution of income or capital from the trust. If you are purchasing an investment you will also need to make it clear whether this is to be a trust asset as opposed to a reduction of the trust’s debt to you. The important thing to remember is that all trustees required by the trust deed to make decisions, must do this before the transaction goes ahead. It is no good getting one of the trustees to sign afterwards. Failure to keep proper records of trust transactions can lead to it being considered a sham trust. In other words, there is deemed to be no trust at all. Also, you risk being sued by any beneficiaries at a later stage. They may also be able take a large portion of the trust funds

Your accountant will always need the sale and purchase agreement and the settlement statements prepared by your solicitor. These set out the purchase price, adjustments such as the apportionment of rates and they show the amount of borrowed money. You should also obtain a statement from your bank showing the movements in your mortgage account and the balance at the end of the financial year. Be sure to include the lawyer’s bill as this may show costs which are tax deductible.

If you have bought the property as a sole owner or in partnership, you can analyze the income and expenditure for yourself. If you wish, you can supply the totals of these. However, be sure to provide full details of repairs and maintenance costs.

If you have bought assets supply the following:

- The name of the asset

- To the date on which you bought it

- Whether you bought any other assets at the same time and if so details

- Whether it was new or secondhand

- The cost