The new 39% marginal rate that applies to all employment income over $180,000 is now in force. Consider how the new rate will affect you and your business.

The 39% tax rate and…

Trusts?

From now on, you’ll need to disclose a lot more information to Inland Revenue in your annual trust tax returns. The additional information will provide the Government with information on how trusts are being used, particularly with the introduction of the new 39% tax rate. As part of their annual income tax return, trustees will now have to disclose:

Financial accounting information, including profit and loss statements and balance sheet items

Loans to related parties

Information on distributions and settlements made during the income year

Names and details of settlors from prior years

Names and details of each person who, under a trust deed, has the power to appoint/dismiss a trustee, to add/remove a beneficiary, or to amend the trust deed.

FBT?

A new Fringe Benefit Tax (FBT) rate of 63.93% will apply for all-inclusive pay above $129,681 and the single rate and pooling of non-attributed fringe benefit calculations. The 42.86% rate for non-attributed benefits will no longer apply. Talk to us about your current FBT profile and we can review it together.

RWT and RLWT?

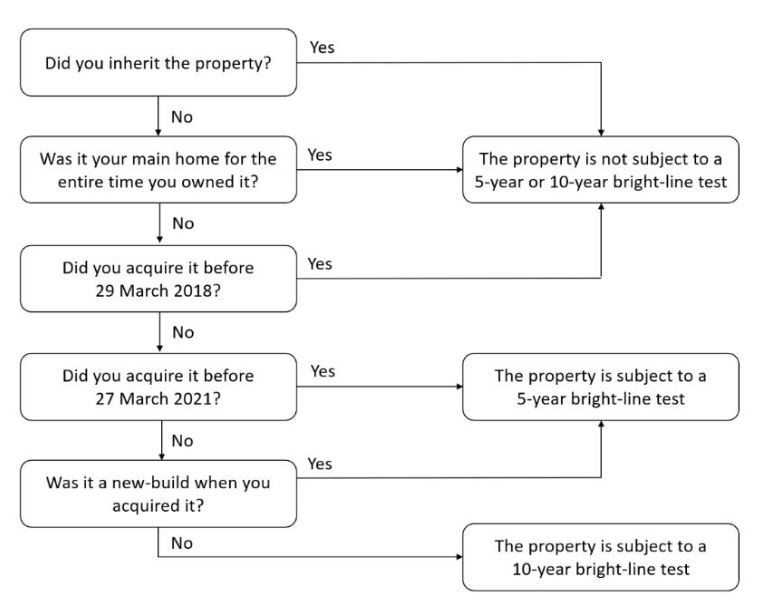

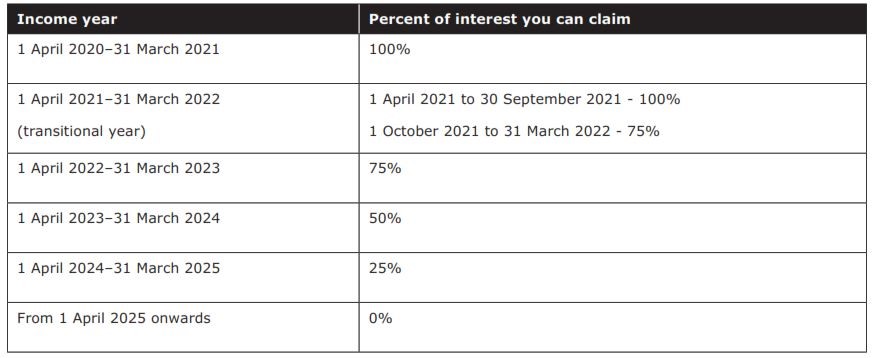

If you earn interest, this will be taxed at 39% (RWT) from 1 October 2021. If you’re selling property covered by the bright-line test, Residential land withholding tax: (RLWT) will increase from 1 April 2021 to 39% (except where the vendor is a company).

Beneficiary income from a trust?

If you receive beneficiary income from a trust let us know if you’d like to know more about your tax position.

Property or shares?

If you are looking to purchase assets such as property or shares, or already have such investments, it would be prudent to assess your overall investment strategy so that it meets your commercial and personal goals, including your tax profile.

Such investments are able to be held in companies or a trust, which have tax rates of 28% and 33% respectively, however on distribution to individuals in most cases the individual’s tax rate will effectively be applied.

A strong note of caution – the main reason for any restructuring of your investments should not be due to any perceived tax benefits arising out of the restructure. Any restructuring should be focused on achieving key objectives such as successful commercial, risk, succession, and asset protection outcomes. Talk to us and we

can review and assist you with planning to meet your objectives.

Superannuation contribution tax?

Time to check whether you have employees whose Employer Superannuation Contribution Tax (ESCT) and Retirement Savings Contribution Tax (RSCT) rate threshold exceeds $216,000. The tax rate for these has risen to 39% (as of 1 April 2021).

Additional employment income?

The tax change applies to all employment income over $180,000 a year, including bonuses, back pay, redundancy, and retirement payments. As an employer, take account of when additional remuneration to employees may affect their tax obligations and make sure tax is deducted correctly.