Residential Rental Property Tax

There are many tax implications when investing in residential property in New Zealand. Property investment and understanding the impact of current tax laws and their application is rather complex now, Please seek professional advice when you are unsure of the implications, as mistakes can be costly!

The Brightline test

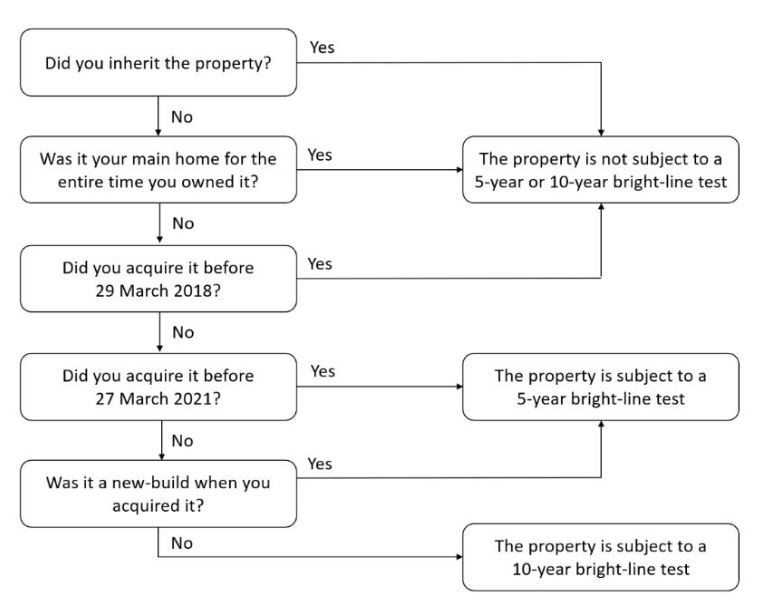

For sale and purchase agreements that become unconditional on or before 27 March 2021, the “old” Brightline test is applied.

All other properties with a settlement date on or after 28 March 2021 will be subject to the revised Brightline test.

Interest deductibility

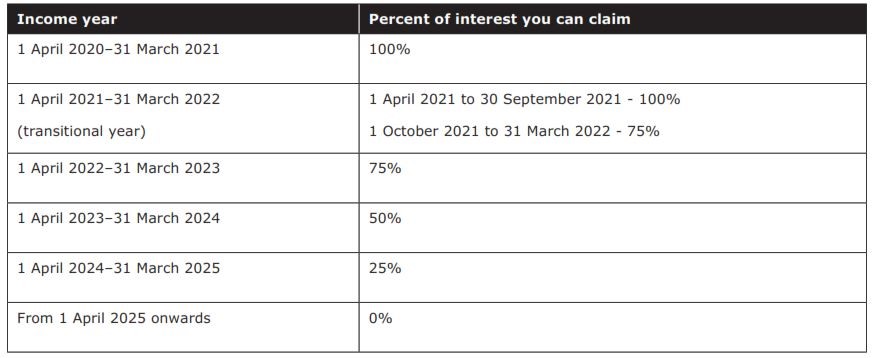

- Property purchased on or after 27 March 2021 – interest can be claimed up to and including 30 September 2021. After that, no interest can be claimed.

- Property purchased on or before 26 March 2021 can claim the percentages outlined below.

Ringfencing Rules

Previously, losses from rental properties can be offset against other sources of income (wages, salary, business income), thereby reducing an individual’s tax liability.

From 1 April 2019 any loss made from a rental property will be ring-fenced. It will be contained within the rental itself and used on a ‘portfolio basis’. The two types of property income losses can be offset against are:

- Future residential rental income from across your portfolio; or

- Any taxable income on the sale of residential land.

Any losses left over will stay ring-fenced to be used in the future against this type of income, ie future residential rental income only and cannot be offset against other personally derived income to lower your overall tax payable, potentially giving rise to a refund

What Expenses can be Claimed

Income from residential property rental should not be declared for GST, and any costs shouldn’t be claimed for GST, either.

Property-related expenses

- Rates

- Insurance

- Property management fees

- Repairs and maintenance

- Travel to and from your property for inspections and repairs

Financing expenses

- Mortgage repayment insurance

- Loan fees

- Interest on mortgage*

Legal and consulting fees

- Legal fees incurred when buying a rental property (if less than $10,000)

- Legal action to recover unpaid rent

- Costs for evicting a tenant

- Preparation of a tenancy agreement

- Accountancy fees

- Valuation fee to obtain a mortgage (but not insurance valuations)

- Legal fees for selling the rental property (if your total legal fees are less than $10,000)

Non-deductible costs

- Mortgage repayments (except interest*)

- Interest subject to the new interest deductibility rules announced 23 March 2021

- Repairs and maintenance, if it increases the value of the asset

- Insurance valuations

- Legal fees for selling the rental property (if your total legal fees exceed $10,000)**

- Advertising the sale of a rental property**

- Real estate commission**

With the government’s new housing plan announced on 23 March 2021, claiming interest against residential rental income has become severely restricted. If you’re purchasing a rental property, assume that interest cannot be claimed.

For properties acquired on or after 27 March 2021:

- Legislation has passed that extends the bright-line test from five years to 10 years on residential property.

- The Government intends for the bright-line test to remain at five years for new builds and will be consulting on what a new build is soon.

- Legislation has passed that introduced a ‘change of use’ rule. If the sale of your property is subject to the bright-line test, and you don’t use a property as your main home for 12 months or more, you will be required to pay income tax on a proportion of the profit made through the property increasing in value.

- The Government has proposed that residential property investors will not be able to offset the costs of the interest they pay on loans to purchase residential property as an expense against their taxable income. A consultation will be held about this, with any law expected to come into effect from 1 October 2021.